Your Medical Benefits

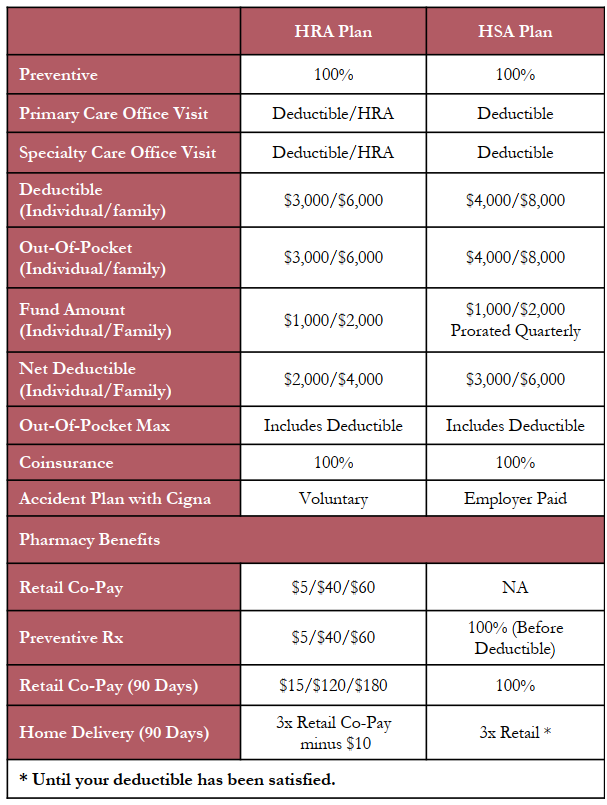

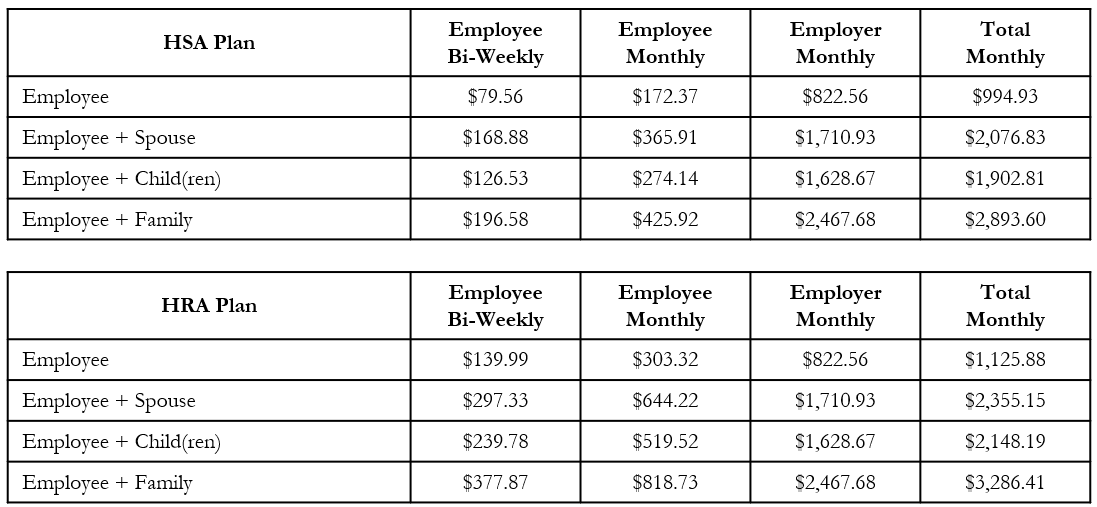

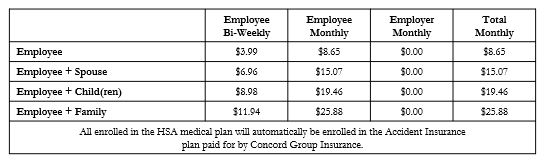

Concord Group provides medical benefits through Cigna Health Insurance. There are two (2) plans available for employees to choose from. Our Health Reimbursement Account (HRA): Concord Group Insurance provides money at the beginning of the plan year for employees to cover part of their annual deductible. A Health Savings Account (HSA): employees can make pre-tax contributions, along with funding from Concord Group Insurance split between January and July (pro-rated for new hires), to help cover eligible expenses.

See below for plan highlights:

Summary of Benefits and Coverages

Summary of Benefits

Summary Plan Description

Contributions

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Health Savings Account Benefits

Employees who elect the Health Savings Account may make a maximum contribution of $4,150 for single coverage and $8,300 for family. These limits include the funding provided by Concord Group Insurance ($1,000 for single and $2,000 for family). If you are over the age of 55, you may make an additional contribution of $1,000. The funding provided by Concord Group Insurance is prorated quarterly for new hires. Employer contributions will be paid in January and July.

HSABank Website Demos

How To: Navigate HSA Bank’s Member Website

Learn how to manage your HSA account anytime, anywhere through our Member Website video demo. The HSA Bank Member Website provides easy access to everything you need to manage your account including balance information, transaction history, requesting distributions, investment details, and much more.

How To: Request HSA Distributions

Learn how to take control of your healthcare payments through our Request HSA Distributions video demo. You can quickly withdraw funds from your HSA (for IRS-qualified medical expenses) through HSA bank’s Member Website.

How To: Request HSA Contributions

Learn how to take control of your HSA contributions through our Requesting HSA Contributions video demo. You can quickly deposit funds, subject to IRS contribution limits, through HSA Bank’s Member Website.

Whether you need to link your healthcare claims to your HSA or pay your medical expenses, we make it incredibly easy to manage all of your IRS qualified healthcare expenses.

This webinar highlights the additional value an HSA can provide in planning for a person’s long term health care expenses, while also showing you the features of HSA Bank’s two investment options.

This webinar highlights the additional value an HSA can provide in planning for a person’s long term health care expenses, while also showing you the features of HSA Bank’s two investment options.

Eligibility

All full-time employees who work at least thirty (30) hours per week and are enrolled in a High Deductible Health Plan. The Health Savings Account Plan through The Concord Group Insurance is a Qualified High Deductible Health Plan.

Your Flexible Spending Account Benefits

Concord Group gives employees that opportunity to set money aside through a flexible spending account. This benefit is provided through csONE Benefit Solutions. An FSA allows you to set aside a pre-determined amount of money to pay for health care and/or dependent care expenses on a pre-tax basis. If you are contributing to a Health Savings Account (HSA), you can elect a Limited Purpose FSA to use for dental and vision expenses only.

General Medical Reimbursement Account

Funds may be used for any medical or prescription expenses covered under your health plan that are not covered under another plan, and any other IRS-eligible expense (including most dental and vision out-of-pocket expenses). Funds are available in full on January 1st and must be used by December 31st of the same year.

Maximum Election is up to the IRS maximum for Health FSA.*

Participants may roll over $640.00 (projected) into the following plan year.

Dependent Care Account (DCA)

DCA funds may be used for eligible dependent care expenses. DCA funds are available as they are deducted from pay. DCA funds not used in the plan year in which they were deducted from your pay are forfeited.

Maximum salary reduction:

$5,000 for single employee or a married employee filing combined tax return

$2,500 for a married employee filing a separate tax return

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

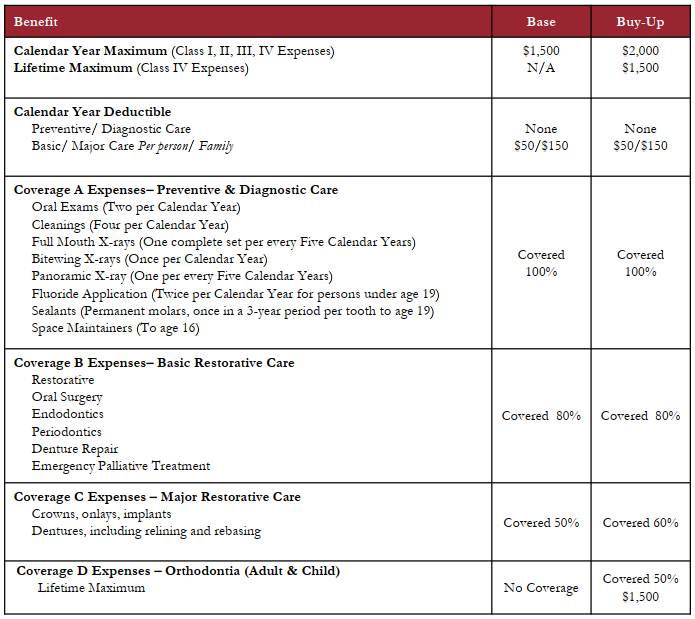

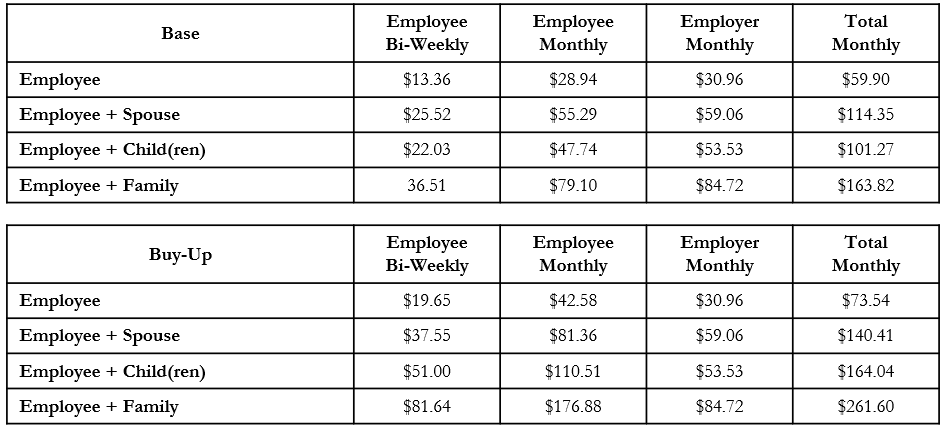

Your Dental Benefits

Concord Group offers employees two contributory dental benefits through Northeast Delta Dental.

Outline of Coverage

Summary Plan Description

Contributions

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Flyers

Northeast Delta Dental Videos

Your Vision Benefits

Concord Group offers their employees two voluntary vision benefits.

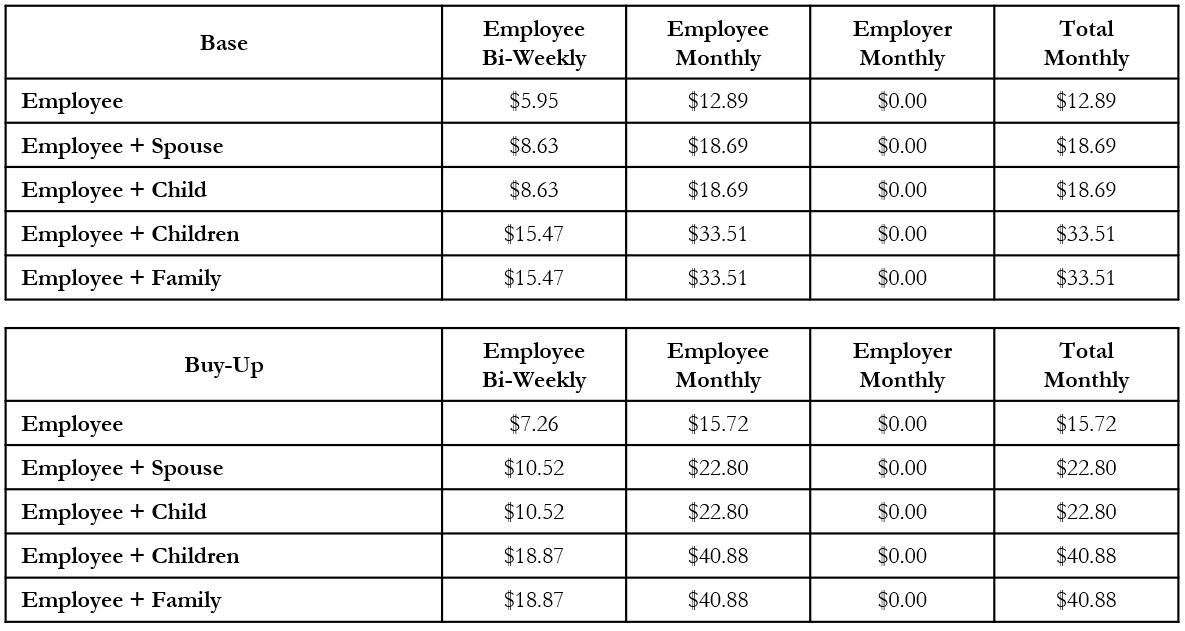

Contributions

Base Plan Documents

Buy-Up Plan Documents

Evidence of Coverage

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Group Life and AD&D Benefits

Concord Group offers employees a life and accidental death & dismemberment policy.

These highlights are for employees who were hired after 2005 – if you were hired before January 1, 2005 please contact HR:

Contributions

This is 100% paid by the Employer.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Voluntary Life and AD&D Benefits

Concord Group offers their employees additional life and accidental death and dismemberment coverage to purchase.

Contributions

This is 100% paid for by the Employee.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Other Plan Information

Electronic Evidence of Insurability

http://www.standard.com/forms/ebid/mhsonly/

The forms online are state specific based on where the Employee lives. Complete the forms, and send back to the medical underwriting team at musc@standard.com

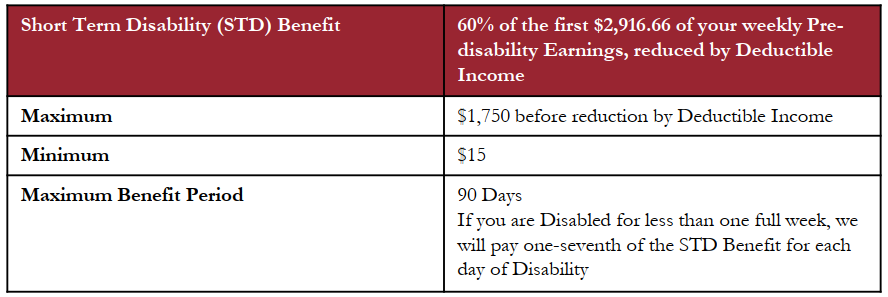

Your Short Term Disability Benefits

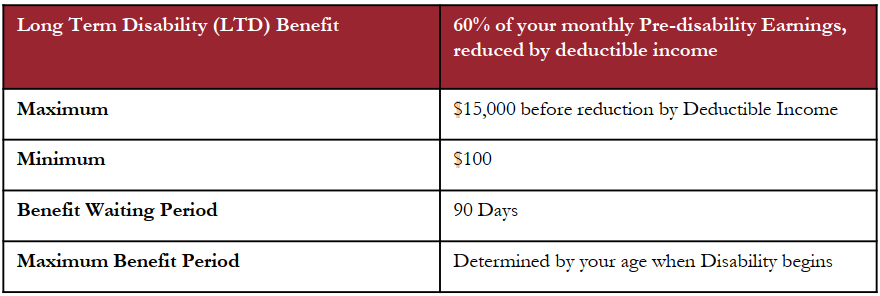

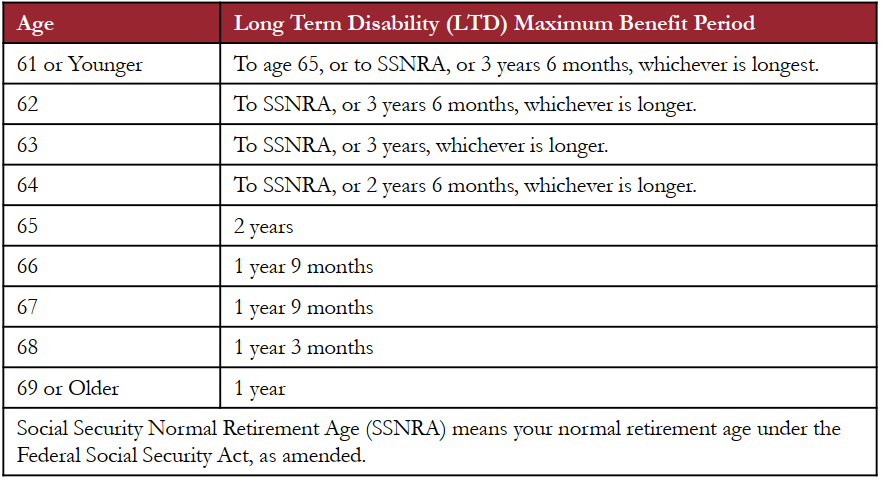

Your Long Term Disability Benefits

Your Voluntary Accident Benefits

Concord Group Insurance offers a voluntary Accident Plan through Cigna.

This coverage provides a range of fixed, lump-sum benefits for injuries resulting from a covered accident, or for accidental death and dismemberment. The coverage includes initial care and emergency care, hospitalization, fractures, dislocations and follow up care. The benefits are paid directly to the insured and may be used for any purpose (healthcare or otherwise).

Contributions

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Voluntary Critical Illness Benefits

Concord Group Insurance offers a voluntary Critical Illness Plan through Cigna.

This coverage provides a range of lump-sum benefits based on your initial benefit amount for critical illness conditions covered. The coverage includes cancer, vascular, nervous system and other specified conditions. For a full list of conditions and lump-sum payments covered visit your Employee Benefit Center. The benefits are paid directly to the insured and may be used for any purpose (healthcare or otherwise).

There is a Health Screen Test Benefit, examples include but not limited to mammography and blood tests. This benefit is paid once a year to the covered individual for $50. The dollars may be used for any purpose (healthcare or otherwise). The payment will come in form of a check addressed to the covered individual.

Contributions

This is 100% Employee paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Voluntary Hospital Indemnity Benefits

Concord Group Insurance offers a voluntary Hospital Indemnity Plan through Cigna.

This coverage provides a range of lump-sum benefits based on your hospitalization. The coverage includes hospital admission, chronic care admission, intensive care unit stay, and hospital observation stay. The additional facility benefits include skilled nursing facility, substance abuse facility, mental and nervous disorder care. The benefits are paid directly to the insured and may be used for any purpose (healthcare or otherwise).

There is a Health Screen Test Benefit, examples include but not limited to mammography and blood tests. This benefit is paid once a year to the covered individual for $50. The dollars may be used for any purpose (healthcare or otherwise). The payment will come in form of a check addressed to the covered individual.

Contributions

This is 100% Employee paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

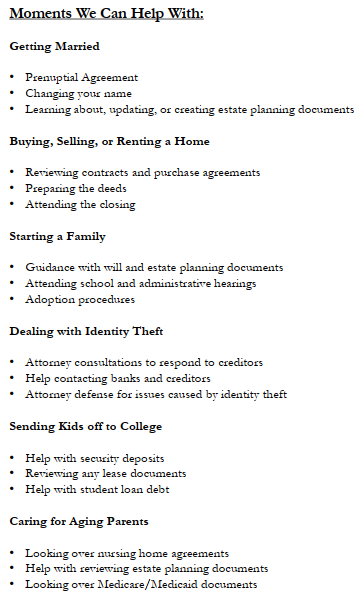

Your Pre-Paid Legal Benefits

Concord Group Insurance knows that life is filled with moments where you might need legal help. Pre-Paid Legal Assistance through MetLife can help with exciting moments like buying a home, to fewer exciting ones like getting a speeding ticket, we make legal help for life’s big moments affordable, accessible, and easy.

Contributions

This is 100% Employee paid.

|

Bi-Weekly |

Monthly |

|

|

$9.12 |

$19.75 |

|

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Employee Assistance Program

Concord Group offers their employees an Employee Assistance Program(EAP).

At some point, we all need help coping or making difficult decisions. The Employee Assistance Program makes it easy to access support, guidance and resources. EAP is there for you and your family through your Group Long Term Disability insurance from Standard Insurance Company (The Standard). And it’s confidential – information will be released only with your permission or as required by law.

Health Advocate provides our EAP services. Their professionals can help with referrals to support groups, a network counselor, community resources or your health plan. If necessary, their professionals can connect you to emergency services.

EAP Services can help with:

- Depression, grief, loss and emotional well-being

- Family, marital and other relationship issues

- Life improvement and goal-setting

- Addictions such as alcohol and drug abuse

- Stress or anxiety with work or family

- Financial and legal concerns

- Identity theft resolution

- Online will preparation and other legal documents

Contributions

This is 100% Employer paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Help Center – 24 Hours a Day, Seven Days a Week

www.healthadvocate.com/standard3

Phone: 888-293-6948

Other Plan Documents

Your Retirement Benefits

Concord Group Insurance offers a 401(k) Retirement Plan through American Funds.

One of the nation’s oldest and largest mutual fund families, American Funds has been helping investors plan for retirement since 1931. All regular employees are eligible first of the month following 2 months of continuous employment. Employer contributions will begin first of the month following 6 months of employment effective January 1, 2021 .

Help Center

Phone: (757) 670-4900

Advisor:

FSRP

Phone: (603) 627-1463

Plan Documents

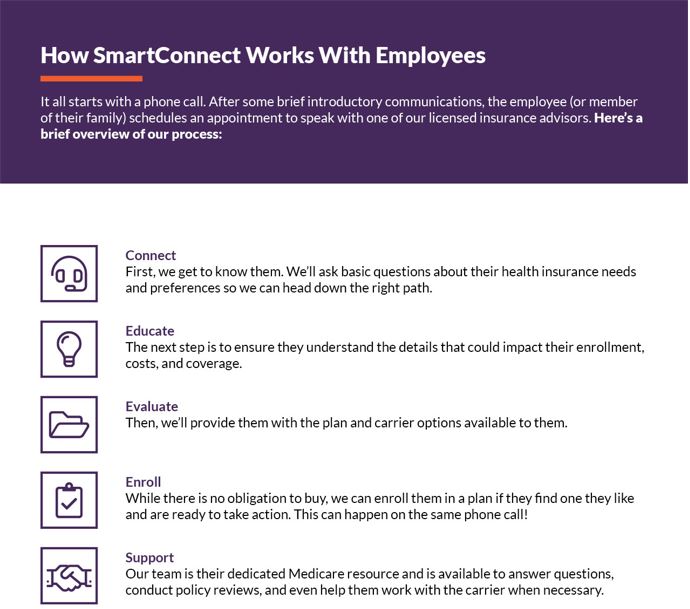

SmartConnect – Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link:

Additional Information

Your Travel Assistance Program

Concord Group offers employees who have a policy with The Standard a travel assistance program with Group Life insurance policies.

This value-added benefit provides an additional sense of security for employees and their eligible family members any time they travel more than 100 miles from home or international travel for trips up to 180 days. A single phone call provides access to a full range of medical, legal and trip assistance services. Wherever your travels may take you, Travel Assistance provides security 24 hours a day, every day of the year.

Key Services of Travel Assistance

• Passport, visa, weather and currency exchange information, health hazards advice and inoculation requirements

• Emergency ticket, credit card and passport replacement, funds transfer and missing baggage

• Connection to medical care providers and interpreter services

• 24/7/365 phone access to registered nurses for health and medication information, symptom decision support, and help understanding treatment options

• Emergency evacuation to the nearest adequate medical facility and medically necessary repatriation to the employee’s home, including repatriation of remains

• Connection to a local attorney, consular officer or bail bond services

• Logistical arrangements for ground transportation, housing and/or evacuation in the event of political unrest and social instability; for more complex situations, assists with making arrangements with providers of specialized security services

This service is only available while insured under The Standard’s group policy. This is administered by Generali Global Assistance.

Contributions

This is 100% Employer paid.

Eligibility

All full-time employees who work at least thirty (30) hours per week are eligible for coverage the first of the month following their date of hire.

Your Tuition Assistance Program

Concord Group tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefit program that is revolutionizing the way employees can reduce their student loan debt.

GradFIN will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

For more information or to schedule a one-on-one consultation visit:

Eligibility

In order to participate in the plan, you must satisfy certain age and service conditions under the plan:

Minimum age requirement: In order to participate in the plan, you must be at age 21.

Help Center

Phone: (844) GRADFIN

For more information or to schedule a one-on-one consultation visit:

Your Discount Benefits

Concord Group employees now have access to huge savings on nationwide entertainment through MemberDeals. Find exclusive discounts, special offers, preferred seating, and tickets to top attractions, theme parks, shows, sporting events, hotels and much more.

- Save up to 40% on Top Theme Parks Nationwide

- Save up to 60% on Hotels Worldwide

- Save up to 40% on Top Las Vegas & Broadway Show Tickets

- Huge Savings on Disney & Universal Studios Tickets

- Preferred Access Tickets™ Find great seats to your favorite concerts, sports and more!

Your Wellness Outlet

Concord Group offers employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.